- Products

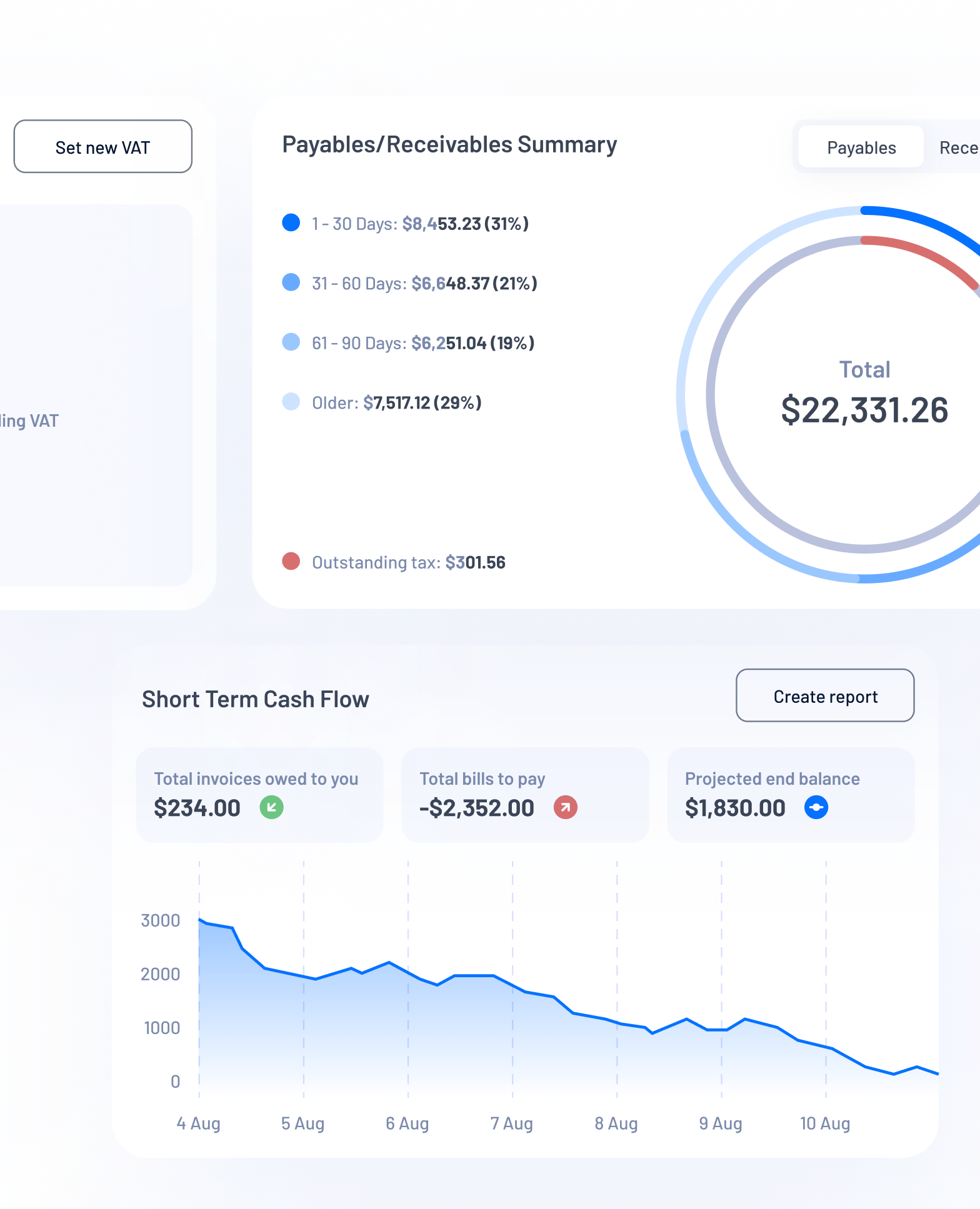

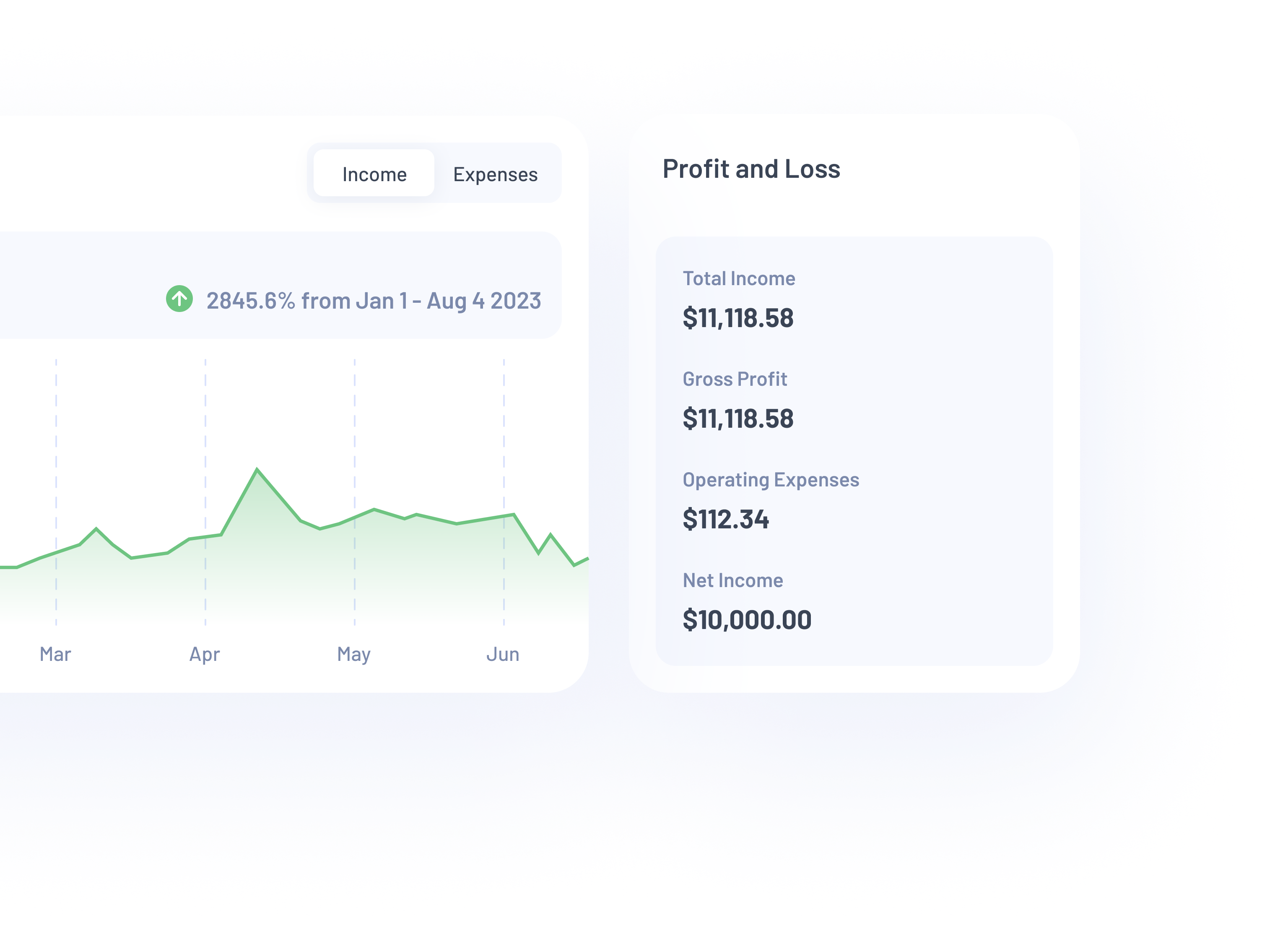

Reporting

Financial reporting–profit and loss account, balance

sheet, expense reports–are an inbuilt feature.Accounting

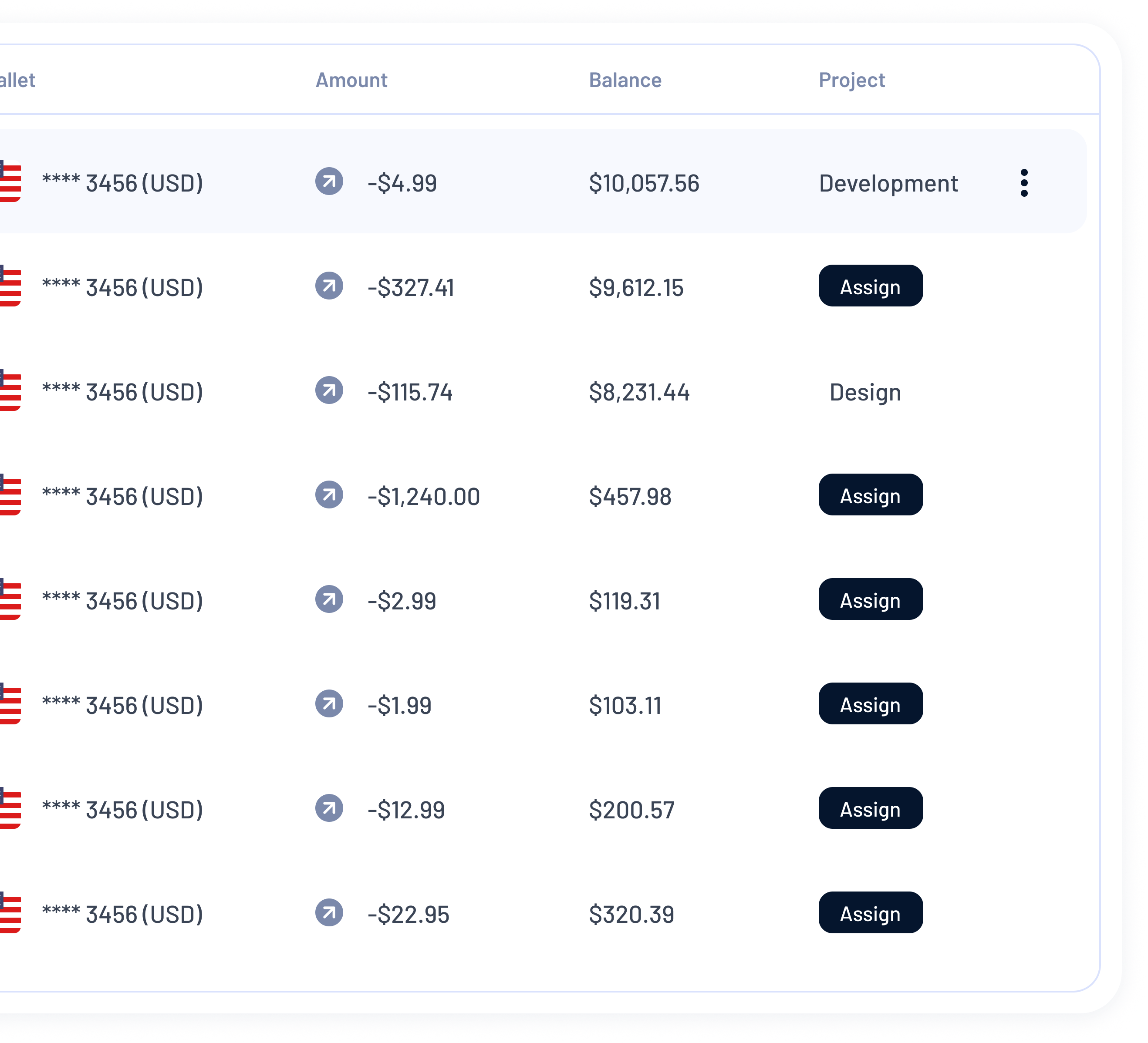

You can streamline your financial operations,

save time, and make informed decisions.Invoicing

Make your team happier with a smarter, simpler

invoice management solution.Convert

Gain live access 24/7 to wholesale currency

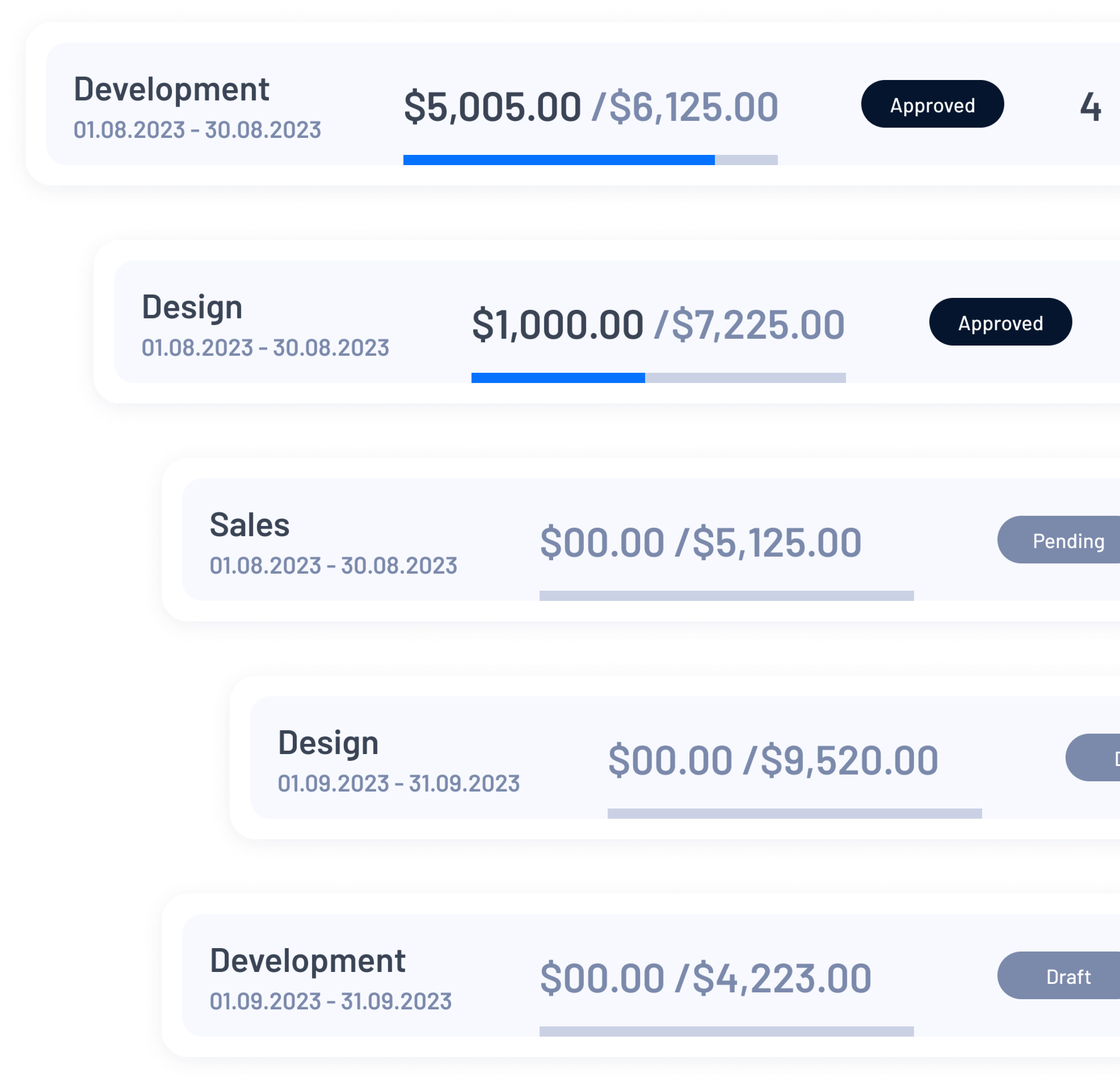

exchange rates.Budgeting

Dashboard to monitor income and expenses

in an easy way.Collect payments

Make international business easy with a

simple, secure, low-cost way to receive money.Cross border payments

Streamlined Cross-Border Payment Solutions

Manage

Manage payments smoothly

- Pricing

- Benefits

- What we offer

- FAQ

- Contact Us

- Products

Reporting

Financial reporting–profit and loss account, balance

sheet, expense reports–are an inbuilt feature.Accounting

You can streamline your financial operations,

save time, and make informed decisions.Invoicing

Make your team happier with a smarter, simpler

invoice management solution.Convert

Gain live access 24/7 to wholesale currency

exchange rates.Budgeting

Dashboard to monitor income and expenses

in an easy way.Collect payments

Make international business easy with a

simple, secure, low-cost way to receive money.Cross border payments

Streamlined Cross-Border Payment Solutions

Manage

Manage payments smoothly

- Pricing

- Benefits

- What we offer

- FAQ

- Contact Us

- Products

Reporting

Final reporting-profit and loss account, balance sheet, expense reports are an inbuilt feature

Accounting

You can streamline your financial operations,

save time, and make informed decisions.Invoicing

Make your team happier with a smarter, simpler

invoice management solution.Convert

Gain live access 24/7 to wholesale currency

exchange rates.Budgeting

Dashboard to monitor income and expenses

in an easy way.Collect payments

Make international business easy with a

simple, secure, low-cost way to receive money.Cross border payments

Streamlined Cross-Border Payment Solutions

Manage

Manage payments smoothly

- Pricing

- Benefits

- What we offer

- FAQ

- Contact Us

- Sign In/Up